Vodafone —

Bundle & Save

UX Research

2021

Glossary

-

PDP - Product details page

-

X sell - Cross-Sell or second service

-

B&S - Bundle and Save

- VCA - Vodafone.com.au

-

CTA - Call-to-action

-

EDM - Electronic Direct Mail

- LP - Landing page

The Bundle & Save campaign is designed to increase customer retention by promoting an additional service that can be added to an existing account. The customer receives a 5% discount on the monthly fee of each of the services up to 20%.

However, a funnel analysis has been conducted and it has been observed that the conversion rate of the campaign is low.

To investigate the phenomenon, a heuristic UX review has been conducted followed by a qualitative study to generate insight and validate assumptions.

As the outcome of this qualitative study, it has been recognised that a possible link between the customers' confidence in understanding the offer and their trust in receiving the best deal leads them to look for alternatives.

![]()

The project has been segmented into three parts. After each part, the insights were shared and workshopped with the team and the stakeholders.

The objective of Data analysis and heuristic review is to individuate friction points, drop points and areas of improvement.

The customer interviews have been designed to deep dive into the insights collected in the previous part. This added an extra layer to the data and help to validate assumptions.

Learning gathered in the first and second parts was used to formulate hypotheses. These hypotheses were then tested to ensure the generation of real benefits for the business and the customers.

However, a funnel analysis has been conducted and it has been observed that the conversion rate of the campaign is low.

To investigate the phenomenon, a heuristic UX review has been conducted followed by a qualitative study to generate insight and validate assumptions.

As the outcome of this qualitative study, it has been recognised that a possible link between the customers' confidence in understanding the offer and their trust in receiving the best deal leads them to look for alternatives.

Process overview

The project has been segmented into three parts. After each part, the insights were shared and workshopped with the team and the stakeholders.

- Data analysis and heuristic review

- Customer interview and survey

- Experimentation and validation

The objective of Data analysis and heuristic review is to individuate friction points, drop points and areas of improvement.

The customer interviews have been designed to deep dive into the insights collected in the previous part. This added an extra layer to the data and help to validate assumptions.

Learning gathered in the first and second parts was used to formulate hypotheses. These hypotheses were then tested to ensure the generation of real benefits for the business and the customers.

Data analysis and heuristic review

1. Funnel analysis

Call-to-actions

It has been observed that the click-through rate on the secondary link "view all plan" is higher than the click-through rate of the primary call-to-action for both the device variations (Apple and Samsung devices).

- "Shop now" - iPhone pages: 10.3%

- "Shop now" - Samsung pages: 5.7%

- "View all plans": 20%

Discounts

In the EDM and landing page, the discounts are expressed inconsistently.

Some are expressed as percent while others as a dollar value, per month or over the life of the contract. It can be unclear or confusing for some users.

In the PDP, the "bundle and save" discount is not displayed. Instead, a discount on the device price is highlighted in purple when applicable.

The customers may think that the device discount on the page relates to the "bundle and save" offer.

Breadcrumbs and related devices

It has been observed 95% CTR on any related device links.

This links move users out of the conversion funnel. However, It has been observed in qualitative studies and data analysis that customers are likely to compare devices before completing a handset order and this behavior has not a negative impact on the overall conversion rate.

![]()

It has been observed 95% CTR on any related device links.

This links move users out of the conversion funnel. However, It has been observed in qualitative studies and data analysis that customers are likely to compare devices before completing a handset order and this behavior has not a negative impact on the overall conversion rate.

Survey

A survey targeted customers who have received and opened an EDM from Vodafone within fifteen days.

The sample was based on the marketing target segment of the Bundle & Save campaigns and included customers aged 24 to 55, in a households of two or more with a combined income of $100,000 or more per year.

304 records have been collected and compared to the Email Marketing database to ensure to be representative the total population.

Questionnaire design

The questionnaire has been structured into five sections including the screener and explored:

The survey was designed to be completed in approximately twenty minutes and it was based on single, multiple-choice,likert, demographic,score and rating questions and NPS.

The sample was based on the marketing target segment of the Bundle & Save campaigns and included customers aged 24 to 55, in a households of two or more with a combined income of $100,000 or more per year.

304 records have been collected and compared to the Email Marketing database to ensure to be representative the total population.

Questionnaire design

The questionnaire has been structured into five sections including the screener and explored:

- Brand familiarity

- Brand loyalty (NPS)

- Preferred shopping and servicing channels

- Devices used, spend, data and inclusions

- Demographics such as hobbies, loyalty program membership, education and employment, household income and structure.

The survey was designed to be completed in approximately twenty minutes and it was based on single, multiple-choice,likert, demographic,score and rating questions and NPS.

Results

The survey showed a positive correlation (ρ 0.86) between the participant spend in telco services and brand loyalty (NPS). Age and location didn’t influence the income-loyalty correlation.

Low spent/loyalty

Customers in this segment seek competitive prices that are clear and transparent. These customers want to stay up-to-date with tech trends but are constrained by budget.

Their interest in offers such as Bundle and Save can be very high. However, these customers are particularly concerned about hidden fees and are likely to shop around looking online and in-store for the best deal.

High spent/loyalty

This segment represents high-income professionals who are looking for innovative services and products.

These customers are highly interested in loyalty programs such as Bundle and Save. However, they are also highly demanding and have low trust in the ability of Telco providers to meet their needs.

These customers look for an emotional connection with the brands, gravitate toward hedonistic products and perhaps impulsive buying.

Customer interviews

Following the survey, twelve participants have been recruited for a one-hour remote interview to deep-dive the subjects of trust in Telco companies and the attitude toward the Bundle & Save offer but also collect feedbacks in regard to the campaign EDMs and LP.

The sample was based on six individuals from the two segments of interest discovered in the survey (Low and High spent/loyalty).

It has been ensured a mix of genders, devices of use and locations (metro areas in NSW and Victoria)

They are also been selected to be the key decision-makers regarding the telco provider.

Methodology

The interviews has been conducted remotely for 45 minutes. The moderator was required to follow a script.

The script has been used only as a general guide supporting the collection of comparable data.

It also allowed for the flexibility needed to create the correct environment for participants to openly express their opinion.

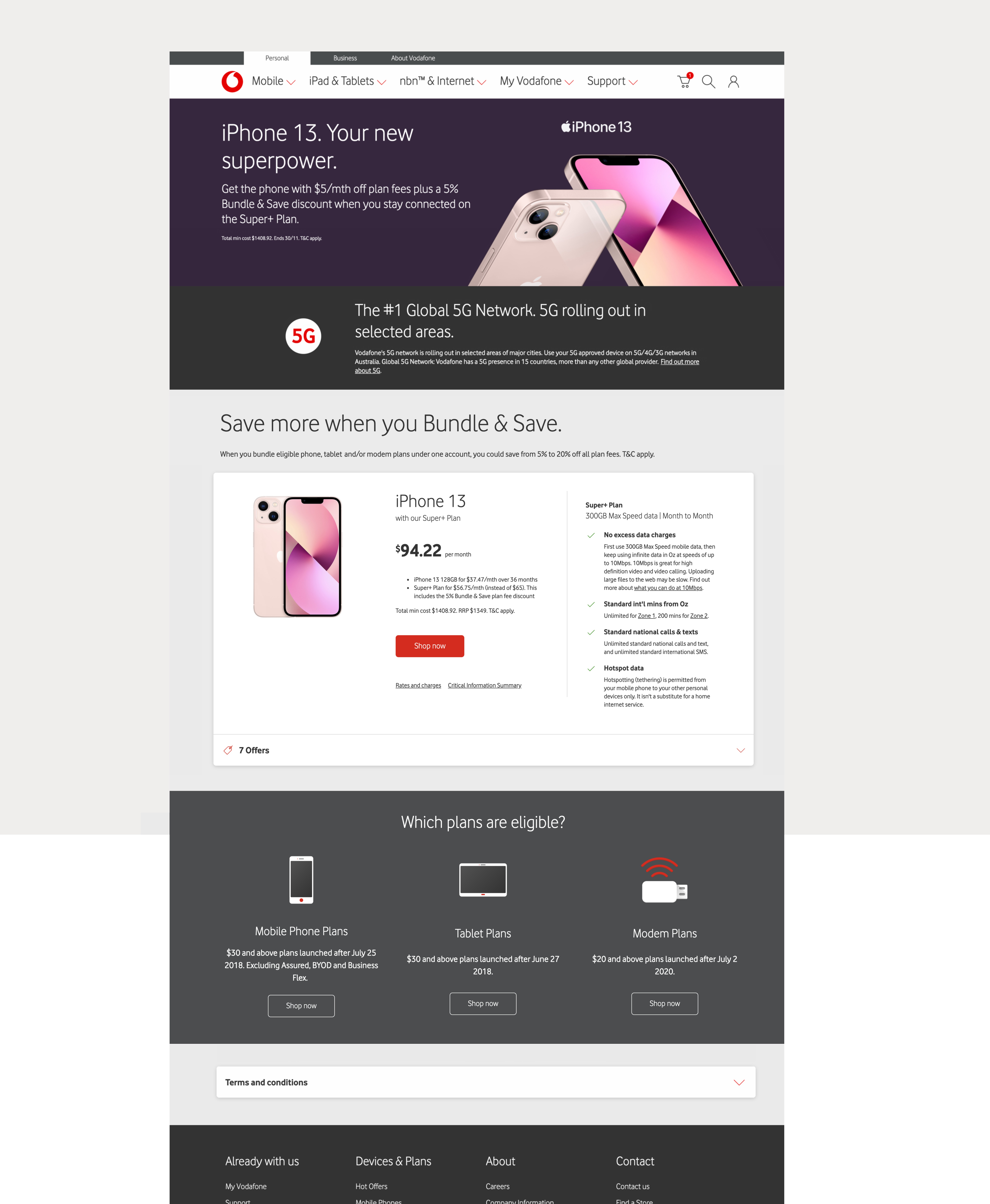

Assuming the device is an important element for the customers, two EDMs presented to the participants featuring iPhone 12 (EDM#1) and Samsung Galaxy 21s (EDM#2). The landing page is based on iPhone 13 (LP).

Highlights

Participants are unable confidently understand the promotional offers and this impact the trust toward their provider.

Participants are unable confidently understand the promotional offers and this impact the trust toward their provider.

Participants understanding of the offer

The participants can describe the offer in EDM#1 and EDM#2 with different levels of confidence. The process requested a significant cognitive effort and took over one minute for all the participants.

Customers mental model associated with device and plan bundle

It is important to notice that the participants at the early stage of interaction with EDM#1 refer to the offer as an upgrade or talk about the device and plan as two independent items.

When exposed to EDM#2, all participants indirectly refer to plan and device as two independent services making them both are eligible for the Bundle and Save discount in their eyes.

The effects of lack of clarity in the offer details

Attitude toward promotional offers

When the participants described their experience of proceeding with a promotional offer, they mentioned that they rely on inspecting the term and conditions or talking with a representative seeking clarifications before proceeding.

The inability of the participants to confidently understand the promotional offers impacts their trust toward the provider and the feeling of not receiving the best available offer.

Purchasing process

Participants stated that they would do further research before redeeming an offer received via email. In the specific example of participant #2, the research for an alternative led to a more beneficial outcome.

The customer attitude of browsing alternatives has been also observed on the website. Users visit several product pages when moving through the cross-sell funnel.

Discount

Coming soon

The participants can describe the offer in EDM#1 and EDM#2 with different levels of confidence. The process requested a significant cognitive effort and took over one minute for all the participants.

Customers mental model associated with device and plan bundle

It is important to notice that the participants at the early stage of interaction with EDM#1 refer to the offer as an upgrade or talk about the device and plan as two independent items.

When exposed to EDM#2, all participants indirectly refer to plan and device as two independent services making them both are eligible for the Bundle and Save discount in their eyes.

A Particiant said "And the iPhone Pro to your current photo field plan, so maybe for an upgrade or just to add it on."

A Participant said "Hoping that is a promotion that will allow me to include a new phone. In this case, the iPhone 12 to my account to save some money. So if I want to have more services like my home internet or maybe another number in the phone, I can save money if I have two or three or four or five services in just one account."

The effects of lack of clarity in the offer details

Attitude toward promotional offers

When the participants described their experience of proceeding with a promotional offer, they mentioned that they rely on inspecting the term and conditions or talking with a representative seeking clarifications before proceeding.

The inability of the participants to confidently understand the promotional offers impacts their trust toward the provider and the feeling of not receiving the best available offer.

A Participant mentioned that if an offer is only available online, she would visit the store and then go online to redeem the offer

A Participant mentioned that if she is interested in an offer she will spend time fully understanding Term and & conditions before clicking on the call-to-action in the EDM.

A Participant said "So that is kind of the problem that a lot of people have with phone companies. [...] there's probably something in the Fine detail, [...]. So then it would be more trustworthy."

Purchasing process

Participants stated that they would do further research before redeeming an offer received via email. In the specific example of participant #2, the research for an alternative led to a more beneficial outcome.

A Participant mentioned that she would look on the website for other offers.

A Participant mentioned two experiences where she has been able to receive a "better" deal after she called the customer care service.

The customer attitude of browsing alternatives has been also observed on the website. Users visit several product pages when moving through the cross-sell funnel.

- 50% CTR on the "view all plans" link in the iPhone12 LP

- Over 90% CTR on the "related devices" link in PDP

Discount

Coming soon

Highlights

Brand recognisability is fundamental to conveying a sense of trust. This has been achieved by creating a curated template that aligns to the brand guidelines and ensures visual consistency.

Brand recognisability is fundamental to conveying a sense of trust. This has been achieved by creating a curated template that aligns to the brand guidelines and ensures visual consistency.

Conclusions

Impact of the EDM template

The EDM is considered a medium to engage with the customers before directing them to the LP.

The first few seconds of interaction with the EDM are crucial to conveying the information that drives the customer's decision to visit the LP.

Brand recognisability and art direction are fundamental to conveying a sense of trust. This is specially relevant for the “high budget and loyality” segment.

Tust and propensity for alternatives

It is expected from discount offers to positively impact product sales by:

- acting in the consumer’s mind as a benefit to them (1)

- reducing the propensity to shop around by acting on the customer's impulsivity (2)

- creating a sense of urgency by leveraging the fear of losing the offer (3)

However, the collected data shows the opposite trend.

In fact, It has been observed a high click-through rate on links allows the user to explore alternative plan or device options (LP "view all plans": 20%, PDP "related devices": 95%).

This customers' behaviour has been explained by the data collected in the survey and the interviews.

64% of the partecipants place “No hidden fees” as their second customer need (after stable connectivity).

It is assumed that the poor understanding of the offer induces customers of seeking clarifications through other channels such as retails or customer care.

78% of the participants that spend $80 or less per month for their mobile service agree that they are likely to compare two or more offers before accepting one.

By exploring alternative offers, the customers may perceive other offers as better than the one received via EDM.

Once this belief is established, the customers will continue to look for alternatives when they receive a commercial offer.

Additionally, during the user interviews, participants stated during the user testing that they would normally look for alternatives or visit the website before accepting a commercial offer.

References

- Coupons.com and Claremont Graduate University Study Reveals Coupons Make You Happier and More Relaxed

- Discounts and Consumer Search Behavior: The Role of Framing

- Why Limited-Time Offers Entice Shoppers to Buy

Value

Proposition Canvas

The insights collected in analysis and customer interviews have been collided and structured in the Value Proposition Canvas.

The Value Proposition Canvas is a detailed look at the relationship between two parts of the Osterwalder's broader Business Model Canvas: customer segments and value propositions.

This tool helps ensure that a product or service is positioned around what the customer values and needs.

When used in conjunction with other artifacts such as competitors landscape analysis, the Value Proposition Canvas can be used to identify areas of improvement which can be further broken down into testable hypotheses and actionable items.

Ideation and testing

EDM redesign

The objective of the EDM is to give the customers the essential information such as monthly cost and Bundle and Save discounts before the next step of the funnel.

The EDM has been redesign to increase brand recognition and avoid information overload.

Landing page redesign

Page structure

Data analysis and interviews uncover the user attitude to explore and compare different products. The landing page has been strucutured to showcase the product vertical eligible and allow the users to explore them.

Device and plan details

The information architecture of the landing page has been improved so to reduce perception overlap by removing irrelevant information.

The dollar value has been removed from the plan name. They are used only to display the actual repayments.

A breakdown in bullet points has been added under the total repayment.